4/18/2022 from John Goglia: The Election Law and Municipal Affairs committee voted 10-9 that SB246 is Inexpedient to Legislate (ITL).

4/7/2022 Hearing of SB246

John Goglia testified on 4/7 before the NH Senate Election Law and Municipal Affairs Committee. Listen to the hearing; Senator Birdsell comes in at about 1:15 and delivers some interesting information and also references our HW community. The audio is faint following Senator Birdsell’s testimony but worth listening (it is corrected at 1:52). John’s testimony is at 2:04 and goes through 2:12.

Although SB246 applies to NEW private road construction (and would not affect Hickory Woods directly) it is important. Acknowledging that there are issues with private roads is a huge step toward rectifying problems.

3/29/2022: Please CALL our representatives to support SB246

The Public Hearing is scheduled for next week April 7. Time is of the essence, so please call the House Representatives below as soon as possible. Below is a phone script you may use, but if you want to use your own words, feel free to add or subtract. Do not mention Tax Credits, this Bill is NOT about Tax Credits and we must keep Tax Credits out of the discussion.

SUGGESTED TELEPHONE SCRIPT: Hello – my name is _________. I am a resident and taxpayer from the Town of _______. I am calling to ask for your support for SB 246, Qualified Private Communities Act. I live on a private road and when I moved in, I really had no clue of the costs and risks associated with owning and maintaining a road system. The cities and towns approve these developments, then they walk away with no responsibility. In many cases, the roads intentionally do not meet town standards. This is not good public policy and NHPVRTA is trying to effect positive change going forward.

SB 246 is a BIG step in the right direction towards fairness and equity going forward for private road taxpayers. It will establish some accountability on the part of private road developers by requiring them to either establish a Capital Reserve Fund or build the road to public road standards. NH needs a private road statute and SB 246 is the answer to that need. Thank you for your consideration of SB 246.

END OF SCRIPT

If you can find out where they stand on the Bill, that would be great. But not necessary if you are not comfortable with that.

If they ask questions you cannot answer, please note the question and send it to contact@nhpvrta.com. We will get back to you with an answer ASAP.

In the case you get through to the representative, after the phone call, send them a thank you email.

Make 3 attempts to get a hold of a live person. On the first attempt, if you don’t get a hold of a live person, leave a voice mail with your name, town and that you are calling to ask for their support of SB 246. Give it 1-2 days between attempts.

If after the 3rd attempt you cannot get a live person, read the paragraph highlighted above into the voice mail with your name, town and phone number and follow-up with an email of the same content.

3/28/2022 Message from NHPVRTA

BREAKING NEWS ON SENATE BILL 246 (QUALIFIED PRIVATE COMMUNITIES ACT)

Dear Private Road Taxpayer,

SB 246 (Qualified Private Communities Act) recently passed the NH Senate. Now it is headed to the NH House of Representatives. The first stop for SB 246 is the Municipal and County Government Committee. They will hold a public hearing on the Bill, and shortly after that, they will make a recommendation to the House on the Bill.

We need a private road statute in NH, and this is our big chance. SB246 is mandatory legislation that requires municipalities to require that developers of qualified private road communities build those roads to public standards or fund a Capital Reserve Account (or both if they choose) for the benefit of the residents to maintain and ultimately replace those roads. SB 246 will serve as the foundation for new paragraphs that may include tax credits and other items in the future.

We need your help to get the committee to recommend SB 246. Please call and / or write the committee members. Phone calls are better than email and keep calling until someone calls you back. For email or letters, ask that your email or letter be made part of the public record. The phone number for the committee is 603-271-3125. The phone numbers and emails for the most important members on the committee are shown below. Everyone should call them.

Whether you call or write, let them know that you want them to vote YES on SB 246 because NH needs a Private Road Statute to address the complexities and issues associated with Private Roads, which are increasing in number rapidly and becoming a larger part of the NH Property Tax Base. If you are a constituent of the representatives you call, identify yourself as a constituent, and leave your name, town, and phone number.

3/24/2022 Article from John Goglia: Private Road Residents Call to Action

SB 246 as amended and Relative to Qualified Private Communities is legislation that has been passed by the New Hampshire Senate and will be heard by the New Hampshire House of Representatives Municipal and County Government Committee sometime in April. This legislation does not impact current residents living on private roads but through passage the Senate has acknowledged that there is a tax unfairness issue pertaining to many private road property taxpayers. SB 246 is sponsored by Senators Regina Birdsell and Sharon Carson and State Representative Wayne MacDonald. SB 246 would require municipalities to only approve new private roads and related infrastructure which meet public road standards or require developers to fund a capital reserve type of account of at least a 50% estimate of projected cost to replace those private roads and related infrastructure at the time of transition to the ultimate residents based on certain factors.

The reason that this legislation is important to current private road residents is because we need to ensure that future unknowing residents do not have to endure the same legal and financial hardships that have unfairly existed for decades. The New Hampshire Private Road Taxpayers Alliance (www.nhpvrta.com) which has been lobbying for 3 consecutive years to get tax relief legislation passed through the state system believes this is the first step to future success for all private road residents. The NHPVRTA is planning for additional tax relief legislation for next year but more public support is needed now.

The NHPVRTA is asking neighborhoods, communities and organizations who pay the same or more property taxes than public road residents without getting any of the same services to write to all the members of the House Municipal and County Government Committee and all their other State Representatives requesting them to support SB 246. The necessary State contact information can be found by Goggling “gencourt.state.nh.us”. Self-motivated individuals should immediately contact the NHPVRTA if they are interested in assisting in this or future efforts to get some long overdue tax relief for private road taxpayers.

3/11/2022 From John Goglia: For all intents and purposes SB250 (Tax Credit) was recommended for interim study but we have been told that it is dead for this year. The NHPVRTA intends to figure out what legislators didn’t like about the bill and get sponsors to file a more appropriate bill next session (2023).

ARTICLE John submitted to newspapers: Private Road Legislation Passes NH Senate

In February, the New Hampshire Senate passed SB246. SB246 mandates that municipalities and developers who approve and build future private road communities with four or more residential units must either construct those roads to existing public standards or the developers must fund a reserve account for up to 50% of the cost to replace those roads at the time of completion of the project. Those funds would be turned over to the eventual resident’s association to maintain and replace those private roads going forward. This legislation is meant to reduce the increased proliferation of private road developments which places an unfair tax burden on unsuspecting residents. SB246 was sponsored by Senators Regina Birdsell and Sharon Carson.

SB250, which would have granted municipalities the authority to offer a tax credit to current residents on private roads did not pass the Senate as amended but recommended for interim study. This was not the expected outcome for SB250 however the NHPVRTA will continue to offer guidance and information to any Senate study of private road issues. Additionally, the NHPVRTA plans to submit further legislation in 2023.

SB246 will soon be scheduled for hearings before a yet to be determined committee in the House of Representatives. Anyone interested in private road legislation should immediately visit www.nhpvrta.com, sign up and follow through with the recommended course of actions.

2/16/2022 Email from NHPVRTA The Election Law and Municipal Affairs Committee is recommending to the Senate that SB 250 go to “Interim Study”. Interim Studies are designed to investigate the content of a Bill and make a recommendation. NHPVRTA feels that an Interim Study is unnecessary since we have researched the private road issue for over 2 years.

We need your help to get these Bills passed. Please call and / or write your NH Senator NOW because the Senate may vote on these Bills any day now. Phone calls are better than email and keep calling until someone calls you back. Whether email or phone call, identify yourself as a constituent of the Senator, and leave your name, town, and phone number. For email, ask that your email be made part of the public record.

Whether you call or write, let them know that you want SB 250 to pass as amended and that the Interim Study will add no value.

Here is the link to find out who your Senator is and how to contact them:

The New Hampshire State Senate NOTE that Londonderry is represented by Senator Carson who is a sponsor of the bill and believes in SB 250.

2/14/2022: ELMA votes

Bad news for residents of private roads! The ELMA (Election Law and Municipalities Affairs) Committee voted on SB 250 – it failed, 2-3. Senator Carson is going to try to introduce the bill before the whole Senate. Stay tuned!

SB 246 passed the ELMA Committee – 3-2.

2/12/2022: Amendments to Legislation

SB246 (Capital Reserve Fund) was basically amended to have municipalities require developers to either build private roads to town standards or establish a capital reserve fund of 50% of the cost to to replace roadways estimated at the time of completion of the project.

SB250 (Tax Credit) was basically amended to require municipalities to offer a tax credit to qualified private road communities based on the community’s prior years costs to maintain roads anBadd some related infrastructure (for communities with public utilities water and sewer) divided by the number of units. The municipality can limit the tax credit to what the municipality reasonably determines it would cost them to provide those same services. The individual residents would still have to apply for the tax credit every year.

2/8/2022 Hearing before the ELMA Committee on SB 250 VIEW ONLINE

- Hearing Summary: (approximate minute marks are included, below)

* Opening to 4:40: Senator Carson (spoke in favor of SB 250)

* 4:40 to 10:00: John Goglia (Tax inequity that private road residents pay double for services; asked for tax break for owners of private road property; detailed the cost of repairing developers’ shoddy road construction)

* 10:00 to 15:00: Lou Gargiulo (Questions about comparing private vs. non private tx)

* 15:30 to 21:50: Dick Swett of Vineyards in Stratham (Talked about road construction standards; compared the tax yield for a community of private road property vs “regular” property; points out that private road owners are actually taxed for the property of the roads themselves.)

* 22:00 to 25:00: Judy Bastian (Lives in an 18 unit private community in Laconia)

* 25:00 to 32:00: Max Nicewinder (Representing NHPVTRA but also lives in Barrington; inadequacy of private roads for emergency vehicles; buyers are “blind” to the financial burdens of private roads; SB 250 provides a tool for towns to provide tax relief.)

* 32:00 t 36:00: Katherine Heck (Representing New Hampshire Municipal Association in opposition to SB 250; concerns include language of the bill; setting tax rates is problematic; determining the cost; appeals process apportioning taxes in condominiums; what is a not for profit entity)

1/25/2022 John Goglia testifies for SB 246 at ELMA Committee hearing

Thanks to John Goglia for all of his work with the NHPVRTA. View his testimony for SB 246. If you advance the YouTube to about 1:40 you will see John’s testimony – about 15 minutes. NOTE that SB 246 advocates for a capital reserve fund for future private road communities and would NOT apply to Hickory Woods. The hearing for SB 250 has not yet been set.

1/15/2022 Time to MAIL the Postcards to the ELMA and Email Legislators

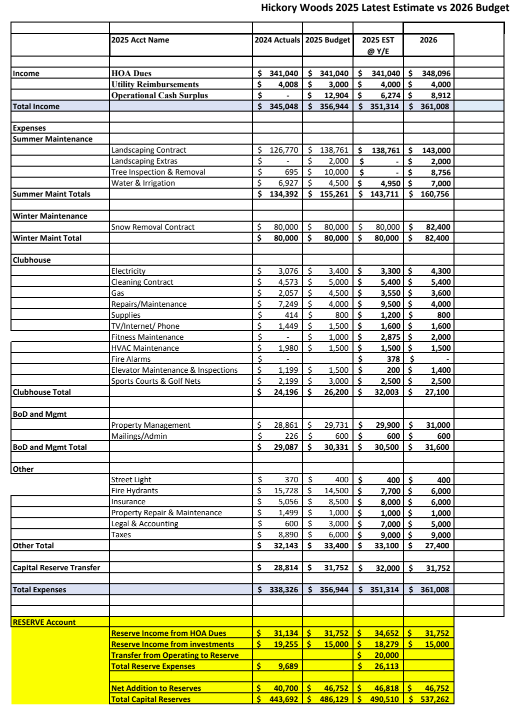

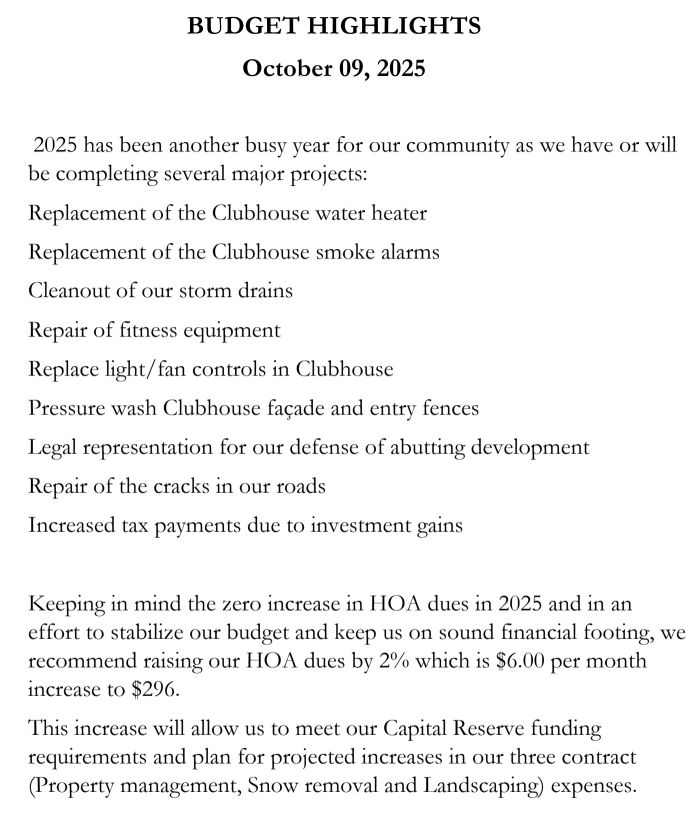

Hickory Woods residents paid $860 per household in 2021 that other residents of Londonderry did not have to pay. The cost of road maintenance, snow removal, street lights and fire hydrants is paid for by taxes…unless you live on a private road. Residents of a private road pay the same taxes as all residents, but do not receive the same services.

To address this TAX INEQUITIES, the NHPVRTA (New Hampshire Private Road Tax Alliance) has proposed SB250. This bill would allow municipalities the option of allowing residents of private roads a tax credit for snow removal, street lighting, fire hydrants and road repair.

.

By now, each of you should have found an “advocacy communication” in your mailbox.

Please MAIL the stamped postcard enclosed! It will let the ELMA (Election Law and Municipalities) Committee know that you support SM 250. Be sure to sign it on the back, print your name(s) and add a brief comment. NOTE:

If you did not receive your postcard to mail, please let Ann Perham know annbperham@gmail.com. .

NEXT STEP is to EMAIL (or telephone) our representatives and senator. Legislators care about constituents’ communications! Here are sample emails that you can copy and paste. Or, use your own ideas/words and write your own email. The addresses of our representatives and senator are below.

.

SAMPLE EMAILS:

1/11/2022 QUICK START FOR ADVOCACY: (Email, telephone contact info)

It’s TIME TO ADVOCATE!

ARTICLE by John Goglia 12/17/2021 in Newsbreak (please read and comment) LINK

UPDATE 12/17/2021 from John Goglia

This has been a good week for the NHPVRTA. Our State Senator Sharon Carson along with 2 other State Senators and 4 House Representatives from Londonderry have sponsored and filed SB 2022-250 relative to a tax credit for qualified private road communities. It would enable municipalities to offer a tax credit but it is not mandatory legislation. This legislation could definitely impact HW.

In addition, State Senator Regina Birdsell, along with Senator Carson and another House Representative from Londonderry have sponsored and filed SB 2022-246 relative to private road communities. This legislation would not impact HW or any existing private road communities. It would make it mandatory for future developers of private road communities to put a certain amount of money into a Capital Reserve Fund to be turned over to the eventual Community Association responsible for maintaining and replacing private roads and related infrastructure. Hearings on both bills will start sometime in early January before the Senate Election Law and Municipal Affairs Committee.

I will have much more about the efforts of the NHPVRTA and what HW residents can do to help us draw legislative attention to these bills next week.

UPDATE 10/27/2021 from John Goglia

The NHPVRTA is happy to report that LSR’s have been filed for both our bills prior to the deadline of 10/28/21. Senator Carson has filed a confidential LSR for the Tax Credit Legislation which is a new wrinkle that we were unaware of in the legislative process until now. Confidential filing means there is no LSR # assigned thus preventing the public or anyone else from raising questions or issues until a later date. Some Senators always use this method when introducing new legislation. Senator Birdsell has filed LSR 2022-2951 Relating to Private Communities for the Capital Reserve Fund Legislation.

.

We believe there will be multiple cosponsors from the Senate and the House for both bills once they work their way through the legislative process. The NHPVRTA continues to encourage our supporters to meet with all 24 Senators and as many of the 400 State Representatives as possible to educate them and get their endorsement for this legislation.

.

None of what we have accomplished so far and what we hope to achieve would be possible without the help of those that would benefit from these changes but we need to do much more in the next few months.

UPDATE 10/13/2021 from John Goglia

Senator Sharon Carson will be filing a Legislative Service Request (LSR) for the Tax Credit Bill in the next 2 weeks. Senator Regina Birdsell will be filing an LSR for the Capital Reserve Bill in the same time period. The LSR is the preliminary step in getting a bill on the Senate docket . This was the easy part. Getting it passed by whichever committee(s) they are assigned to is tougher. Then the full Senate votes and if passed it goes to the full House of Representatives for another vote. If it makes it passed there it goes to the Governor who can still kill it. If he signs it the individual municipalities must also decide to adopt. We have some momentum now but sustaining it will be our biggest challenge but the NHPVRTA has been relentless so far. We have about 350 supporters from approximately 50 individual cities and towns throughout NH but we need to reach many more. We are always trying to recruit volunteers to assist us.

UPDATE 10/10/2021 from John Goglia (NHPVRTA Director and Treasurer):

This Wednesday, 10/13/21 is the first day that a Legislative Service Request (LSR) which is the preliminary process to filing a Senate bill can take place. We think our own Senator Sharon Carson will again sponsor our bills but the NHPVRTA currently has pockets of private road individuals and communities throughout the state trying to meet with their respective Senators and State Representatives and get them to also sponsor and support our 2 bills.

.

The first bill is a tax credit determined by each individual municipality which if enacted into law at the state level would also have to be adopted by each municipality and then individual private road taxpayers would have to file for the tax credit every year. We determined that there is a better chance for success if individual municipalities retain some control of this process rather than make it mandatory. This bill would directly affect us at HW.

.

The second bill requires future developers who build a private road community to create a Capital Reserve Fund based on certain factors at the time of completion so that communities would have some initial seed monies for maintenance and replacement. This bill would not affect existing communities like HW but it is intended to somewhat restrict the proliferation of the development and approval of private road communities.

TEXT of BILL

.

Anyone wanting more information should visit our website at www.nhpvrta.com.

UPDATE 8/7/2021 from John Goglia

Bob Mederiros, Matt Niswender of NHPVRTA and I met with Senator Sharon Carson and Senator Regina Birdsell at the HW Clubhouse for almost 2 hours on Friday, 8/6/21. We gave them a tour of the Clubhouse and they took a drive around the community to check out the roads.

(l-r): Senator Sharon Carson, John Goglia, Senator Regina Birdsell

We told them about two draft bills that the NHPVRTA is seeking sponsors for in the Senate and/or the House for the 2022 Legislative Session. One preliminary bill asks for the state to give municipalities the authority to issue a tax credit for a reasonable amount to be determined by the municipality for services not rendered to private road residents who live in a qualified community. The individual homeowners would be required to file for that tax credit every year.

The second preliminary draft bill asks for developers to create a Capital Reserve Fund in the amount of 50% of the estimated cost of road and infrastructure replacement at the time of transition to be given to the HOA for road issues. Obviously this bill would not pertain to us.

The Senators took everything under advisement, asked good questions, made some suggestions and said they would get back to us once they have talked with other Senators and their own constituents in other towns that they represent. They requested some additional information from us which we will provide shortly. We are hoping to be able to work with them on legislation that both sides find appropriate.

They did offer that individual homeowners might consider requesting a tax abatement from the town based on land value alone and not including structures for the lack of services not being provided. This idea may have some merit and we will explore.

.

We told them about the easement at the beginning of Tavern Hill Road for access to the commercial property because the state will not allow access to that commercial property from Rt.102. We told them it doesn’t seem fair that the developer agreed to the easement on our private road and now we have to live with that possibility. They indicated that is a very difficult issue to resolve as they have been involved in somewhat similar circumstances in other towns without success. The State DOT apparently has the last word since Rt.102 is a state road.

Email from NHPRTA 8/12/2021: NHPRTA Meets with NH Senators to Introduce New Bills

On Friday, August 6, Senator Sharon Sharon Carson (Londonderry) and Senator Regina Birdsell (Hampstead) met for 2 hours with Board members of NHPVRTA at Hickory Woods (Over 55 community) in Londonderry. Also present was a member of the Hickory Woods Board of Directors. The purpose of the meeting was to introduce two (2) draft Bills on private road communities to the Senators.

In anticipation of the 2022 NH Legislative Session, NHPVRTA is seeking sponsorship and support for these Bills from both these Senators as well as other Senators and State Representatives. One bill will allow cities and towns to adopt a tax credit for property owners on private roads. The second bill would require developers of new private road communities to either create a Capital Reserve Fund OR the proposed roadways must meet the current design requirements of public roads.

This meeting with the Senators was very cordial and informational for all parties. The Senators agreed to consult with other Senators and their respective constituents in the other towns they represent to get some feedback before providing any commitment to support either of these Bills.

If you live in Auburn Londonderry or Hudson Sharon Carson is your Senator. If you live in Derry or Hampstead or Windham Regina Birdsell is your Senator. You may contact them to show your support for these Bills.

3/15/2021 Email from the NHPVRTA

Dear Private Road Taxpayers,

During an Executive Session on Tuesday, March 9, the NH Senate Transportation Committee deleted Part IX of SB-131-FN. The committee discussed the concept of revising the Bill to form a Study Committee, but in the end they decided to delete Part IX on Private Roads.

Those wishing to reach out to the committee may do so by using the information shown below. We especially encourage you to contact the Chair and Vice-Chair with your comments and questions about their decision.

If any new information develops, we will send out a communication. For the foreseeable future, NHPVRTA leadership will be formulating our strategy for the next legislative session.

Thanks to all who supported the Bill,

NHPVRTA

SENATE TRANSPORTATION COMMITTEE:

- Senator Regina Birdsell (Chair of Committee)

District 19: Derry, Windham, and Hampstead

Phone: 603-271-2609

Email: Regina.Birdsell@leg.state.nh.us

- Senator David Watters (Vice Chair of Commmittee)

District 4: Barrington, Dover, Rollinsford, Somersworth

Phone: 603-271-2104

Email: david.watters@leg.state.nh.us

- Senator Ruth Ward

District 8: Croydon, Newport, Unity, Acworth, Stoddard, Antrim, Deering, Weare, Bradford, Sutton, Newbury, Springfield, New London, Sunapee, Goshen, Grantham, Lempster, Washington, Marlow, Hillsboro, Langdon, Windsor, Bennington, Francestown

Phone: 603-271-2609

Email: ruth.w ard@leg.state.nh.us

- Senator Denise Ricciardi

District 9: Bedford, Dublin, Fitzwilliam, Greenfield, Hancock, Jaffrey, Lyndeborough, Mont Vernon, New Boston, Peterborough, Richmond, Sharon, Temple, and Troy

Phone: 603-271-4151

Email: Denise.Ricciardi@leg.state.nh.us

- Senator Tom ShermanDistrict 24: Greenland, Hampton, Hampton Falls, Kensington, New Castle, North Hampton, Newton, Rye, Seabrook, Stratham and

South Hampton

Phone: 603-271-7875

Email: tom.sherman@leg.state.nh.us

3/9/2021 Update from John Goglia

Some unfortunate but not totally unexpected news today. The Senate Transportation Committee held an online Zoom Executive Session this afternoon to discuss the various parts of the above Omnibus Bill.

As to section IX on private roads they were considering to send it to a study committee due to the strong support and extreme complexity of this legislation. However, they ultimately decided to delete it from passing through to the entire Senate.

The NHPVRTA has learned a tremendous amount of information about this issue and the legislative process which can only be beneficial going forward. That being said we hope to move forward but we do need some fresh perspectives and new energy. Anyone interested in assisting in pursuing this further should contact the NHPVRTA at

www.nhpvrta.com

The NHPVRTA will be following up with the 5 Senate Members of the Transportation Committee as to their specific reasons for deletion.

3/5/2021 Update from NHPVRTA

The Public Hearing for SB-131-FN in front of the Senate Transportation Committee took place on March 2nd at 1:15 PM. Part IX of this Bill would require NH Municipalities to either maintain private roads in the same way as public roads or provide tax credits to private road taxpayers. If you want to watch the Hearing you can replay the recording at this link. For Part IX, fast forward to the 2 Hour and 11 minute mark of the recording.

3/3/2021 Feedback from John Goglia on 3/2 testimony:

We had to wait over 2 hours for our part of the omnibus bill to be introduced. Several people spoke in support and last one was from the NH Municipal Association who opposed. We thought our points were made but committee members seemed to lose interest due to total length of hearing. Opposition stated if the legislators allowed this to pass there would be utter chaos, it would cost municipalities tens or even hundreds of thousands of dollars and claimed it is unconstitutional to use tax funds for private road purposes. We think we can refute those statements but we are trying to figure out best way to handle.

Short story it appeared to the NHPVRTA that the Committee was looking for a reason to kill our part. It doesn’t look good. The NHMA spokesperson did tell the committee citizens can ask Towns to take over their roads but they have to meet town standards.

2/27/2021 From the NHPVTRA Board of Directors

Dear Private Road Taxpayers,

Senate Bill SB 131-FN is scheduled for a Public Hearing in front of the Senate Transportation Committee on March 2nd at 1:15 PM. Part IX of this Bill would require NH Municipalities to either maintain private roads in the same way as public roads or provide tax credits to private road taxpayers.

You can make a difference in our effort to get SB 131-FN Part IX approved by the Senate Transportation Committee in two ways:

1. Testify at the Hearing via Zoom in support of SB 131-FN Part IX. (NOTE: no additional speakers are needed)

To view/listen to this hearing on YouTube on 3/2 and 1:15 PM, use this link.

2. Email members of the Transportation Committee urging them to support the Bill using the link directly below. We recommend you email the Entire Committee.

Together we can begin to rectify the unfair situation faced by NH private road taxpayers. But we need broad support.

POSSIBLE EMAILS TO SEND (copy and paste; edit as desired): #1 EMAIL #2 EMAIL

2/18/2021 from John Goglia:

HERE is a copy of the private road bill filed yesterday by our Senator Sharon Carson, Londonderry. Unfortunately it was combined with 8 other bills but that is what we have to work around. To summarize as briefly as possible, SB-131-FN, Part IX basically authorizes municipalities to provide qualified private road communities with the same services that municipalities provide to residents on public roads to include snowplowing, road repair, road replacement and maintenance of certain corresponding infrastructures such as municipal water and sewer systems. In lieu of providing those services the municipalities would have the option to offer individual private road homeowners a property tax credit representing the municipalities estimated costs of providing those services. The credit would not be automatic but rather we would individually have to apply for the credit much like the veterans property tax credit.2/18/2021 From John Goglia – PLEASE ADVOCATE for the new bill:

So now comes the hard part, trying to convince our legislators in Concord that they must pass this bill. To do that I am asking you to do two things:

- Visit www.nhpvrta.com and sign up to get notifications about the progress of the bill. This also allows the NHPVRTA to speak on behalf of as many private road homeowners as possible before the Senate Transportation Online Hearing on Tuesday, 3/2/21 at 1:15pm. Those of you who already signed up will get further information from the NHPVRTA.

- Use this link to request every member of that committee to support passage of SB-131-FN, Part IX. Click on “Email all members” to send a message to all on the Transportation Committee.

2/14/20201 PLEASE SIGN UP on the website http://www.nhpvrta.com to receive regular updates. To date, we have 15 HW units represented. We need 98!

2/6/2021 John Goglia explains the purpose and goals of the NHPVRTA http://www.nhpvrta.com in this video. Text, below.

John’s message:

If you live on a private road, you are aware of the unfair financial and legal burdens associated with those roads compared to public roads. Generally speaking, private roads are not as safe not as durable as public roads yet property taxes are the same for both types of roads. Private road developments are a huge financial bonanza to the municipalities that approve them and the developers who build them because neither has any financial or legal responsibilities after occupancy. Allowing substandard roads and corresponding infrastructure is not good public policy especially for the residents who ultimately bear the costs.

There is a state-wide nonprofit organization trying to rectify this injustice. Soon, a bill similar to what has already become law in New Jersey and Maryland will be filed in the NH Senate. Please take the time and sign up for our mailing list on www.nhpvrta.com so that you can be advised of the progress of the bill. Helping to support this common cause could mean substantial long term financial savings for all of us.

1/31/2021 John Goglia asks us all to, “show support for the forthcoming private road bill by signing up on www.nhpvrta.com asap.”

12/16/2020 UPDATE from John Goglia:

- Senator Sharon Carson of Londonderry has filed a Legal Service Request (LSR) this week which is the preliminary step to filing a bill in the NH Senate addressing issues of importance to owners of property on private roads such as in Hickory Woods (HW). Those issues include property tax assessments, road maintenance, snowplowing, water and sewer infrastructure, lighting and road safety. Once the Legal Legislators in Concord complete the exact bill wording the NHPVRTA will be notified of the bill number, probably early January.

- The NHPVRTA of which I am now a Director and Treasurer is trying to bring attention to the extra expenses incurred by all owners of property on private roads throughout NH. We currently have supporters in over 20 cities and towns represented by over 200 individuals and growing but we need more.

- I would ask that everyone in HW go to our website at NHPVRTA.com and complete a contact information form so that we can speak on behalf of as many private road residents as possible when a hearing takes place sometime early next year. This is an opportunity for all of us to voice our concerns at a level that has the authority to rectify any injustices that we can document and articulate.

- I also would encourage anyone that is interested in helping the NHPVRTA on a limited basis to contact me.

- I will keep HW informed as this legislation hopefully progresses through next year.

10/31/2020 UPDATE: Our own John Goglia is now a member of the NHPRTA and is its Treasurer. He passes along this information:

- Check out updated website at www.nhpvrta.com

- Sometime after the election a new bill will be introduced in the House of Representatives to form a committee to study the fairness and issues of private roads in NH and hopefully make recommendations somewhere between alleviating the unfairness or banning the future construction of more private roads.

- As to the Londonderry Senior Community Coalition we are attempting to obtain information about what the other Over 55 Communities do to get applicants for their BOD and what the older communities have done in the way of road maintenance. This information could help the newer communities make better strategic decisions to preserve our roads. We intend to explore other common issues to use the experience of other communities to help all of us avoid mistakes.

7/2/2020 UPDATE: Unfortunately due to the impact of Covid 19 the NH Legislature has been addressing more priority issues. HB 1490 to form a committee to study the taxation of owners of property on private roads which passed the House of Representatives in January has been “laid down” and will have to be refiled. The NHPVRTA which has been the driving force behind this legislation will file an amended bill either in the House or Senate at the appropriate time. Our own State Senator Sharon Carson has offered to sponsor an amended bill if she wins reelection in September.

The NHPVRTA is currently using the Covid 19 down time to broaden their state-wide support base and is looking for volunteers to assist in that endeavor. Please contact John Goglia for further information.

Also the Londonderry Senior Community Coalition (LSCC) comprised of all 11 Over 55 Londonderry communities held a virtual meeting 6/24/20 the first since February, 2020. This group is formulating a mission statement and election of officers to collectively represent the concerns of our communities.

4/29/2020 UPDATE:

The NHPVRTA website is now available: http://NHPVRTA.com

~ Promoting fairness and equity for Private Road Taxpayers

2/21/2020 UPDATE:

The NH Private Road Taxpayer Alliance (NHPVRTA) recently advised us that on 2/18/20 the House of Representatives, Municipal & County Government Committee (MCGC) in Concord passed HB1490 to establish a committee to study the taxation of owners of property on private roads by a vote of 12 to 6.

.

HB1490 will now move on to a vote by the full House of Representatives at some future date. In the meantime

anyone wishing to support this bill should contact any or all 7 State Representatives from Londonderry (listed, below). Contact info for all NH representatives is on the NH

House of Representatives website. State Rep Tom Dolan is on the MCGC and is also a member of our Town Council. Dolan supports the bill.

SAMPLE EMAILS that you could send are listed below

- Londonderry State Representatives:

In addition, there is another bill, HB1533 limiting property tax increases to 1% per year to all individuals 67 years of age and older and others with disabilities before the MCGC that has been heard but not ruled on yet. Although we were recently made aware of this particular bill by the NHPVRTA, no particular individual is monitoring it for us at present.

Questions? Contact John Goglia, 603-203-4888

RECOMMENDED EMAILS TO SEND TO LEGISLATORS: Modify as you wish

Short Email

Thank you for considering HB 1490, An Act to establish a committee to study the taxation of property owners on private roads. Taxation of Private Roads needs to be studied. Private Road taxpayers do not have access to the same services as our counterparts that live on Public Roads, and from that stems many issues, including but not limited to unfair taxation and the safety of private roads. This is a statewide problem that needs to be addressed. I ask you to vote in favor of this Bill.

Thank you for considering my thoughts on HB 1490,

YOUR NAME HERE

Your Street and Town

Longer More Detailed Version

I am writing to ask for your support of HB 1490 – AN ACT establishing a committee to study the taxation of property owners on private roads. New Hampshire has seen a proliferation of private road residential communities. Residents of these private roads are charged the same tax rate as residents of public roads, but are denied access to the same services offered to public road residents. Specifically those living on private roads must pay for all costs associated with the road including plowing, installation and replacement of drainage culverts, plant control, and repaving the road while the cities and towns provide those services to public road residents. That does not seem to be fair or equitable.

In addition, there appears to be a trend toward an increase in the approval and building of private road developments. I do not believe that tax payers in these private road residential developments have been fairly represented by the developers, planning boards and town and city councilors. Developers maximize land use by clustering homes in these developments which help maximize the developer’s profit and compromise the quality and safety of the roads in those private communities. The city/town gets increased tax revenue without the responsibility of taking care of the roads and in some cases utility infrastructure. Everyone wins except the private road residents.

Finally, some private roads are such that emergency vehicles may not be able to service homes located on them. There are many issues that need to be addressed, and since the issues vary across the State, the right thing to do is for the State Legislature to form a committee to study the problems associated with private roads in NH, especially the lack of access to services that are provided to public roads.

Thank you for considering my thoughts on HB 1490,

YOUR NAME HERE

Your Street and Town

Wednesday February 19, 2020

Neighbors,

Yesterday at our Board meeting, Bob Medeiros spoke briefly about HB1490. This bill would create a committee to study the taxation of private roads. The information below is from NHPRTA and is requesting your support and assistance.

Sincerely,

Your Hickory Woods Board of Directors

Dear NH Private Road Taxpayers,

Please take a few moments to draft and send an email to the committee that will be deciding HB 1490, the Bill that will create a committee to study Taxation of Private Roads. Tell them why you want them to support HB 1490.

NHPVRTA

The email address for the committee: HouseMunicipalandCountyGovt@leg.state.nh.us

If you want to email individual members, their names and email addresses are shown below:

Marjorie Porter(D) Marjorie.Porter@leg.state.nh.us

Susan Treleaven(D) streleaven@comcast.net

Julie Gilman(D) Julie.Gilman@leg.state.nh.us

David Meader(D) David.Meader@leg.state.nh.us

Paul Dargie(D) Paul.Dargie@leg.state.nh.us

Jim Maggiore(D) Jim.Maggiore@leg.state.nh.us

Donna Mombourquette(D) Donna.Mombourquette@leg.state.nh.us

Laurel Stavis(D) Laurel.Stavis@leg.state.nh.us

Tom Dolan(R) Tom.Dolan@leg.state.nh.us

Vincent Paul Migliore(R) vpmigliore@leg.state.nh.us

Mac Kittredge(R) Mac.Kittredge@leg.state.nh.us

John MacDonald(R) John.MacDonald@leg.state.nh.us

Mona Perreault(R) Rperre4474@aol.com

Tony Piemonte(R) Tony.Piemonte@leg.state.nh.us

Kevin Pratt(R) Kevin.Pratt@leg.state.nh.us

Tony Lekas(R) rep.tony.lekas@gmail.com

Max Abramson(L) Max.Abramson@leg.state.nh.us